A quick question: hands up how many of you wait until stocktake is complete, or the accountant asks for end-of-year reports, until you realise there is a problem with your inventory? That’s not good enough and you should know better!

If your retail shop is like most others, inventory accounts for 95-100% of your sales revenue. It’s probably also where you have hundreds of thousands of dollars invested. So why aren’t you spending more time managing that investment?

We’ve observed many retail managers over the years. Without a doubt, the most successful retailers have more stock turns than average. They recoup their investment on inventory more quickly than others. To help achieve this they check a few key inventory reports on a regular basis. They use this information to improve efficiency and profitability of their shop.

When reports are looked at regularly the effort required to inspect and fix inventory problems is greatly reduced. It is quicker and easier than dealing with a few problems, sporadically, than a large number of problems all at once.So here are the four reports that, when looked at regularly, will give you maximum benefit with minimal time investment.

1. Negative Stock

Negative stock is where your POS system reports your on hand stock has fallen below zero. I.e. -1, -2, -3, etc. Essentially this means you have sold more than you have purchased for a particular product. You need to regularly run a report to locate such products.

WHY?

Stock might be negative due to:

- Items are being incorrectly looked up by code or description instead of scanned in by barcode.

- When similar items are presented at checkout, operators are scanning one barcode and multiplying it out, instead of scanning each item which in a customer’s basket might differ slightly in colour or size.

- Invoicing and collecting payment from a customer before you buy in the items from your supplier. This could include special orders where you ask for the customer to pay up front.

- Putting goods on the shop floor and selling them before the purchasing paperwork has been applied.

- Incorrect counting at stocktake time, or manual “fiddling” with on hand stock figures in your database.

Incorrect stock counts may have company tax implications. They can also indicate that sales figures are incorrect. Are you willing to make business decisions on incorrect data? Probably not.

Finding problems sooner helps sort issues out while they are fresh in people’s minds and correct errors as you go.

HOW?

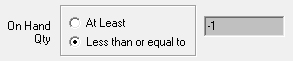

Find your inventory listing or on hand stock report, filter by quantity less than zero.

If you don’t have a filter, then sort the report by on hand quantity. This might require exporting to Excel and then sorting by the quantity column.

WHAT TO DO?

Work through a couple of products and figure out why they are negative.

- Is paperwork behind in purchasing? Then apply all the incoming invoices from suppliers and re-run the report.

- Are staff picking up the wrong goods when selling? Are they scanning each barcode, or multiplying out? Then let them know the effect this is having.

- Has an error been made in purchasing? You might want to go back and alter the invoice in your system to correct errors.

- Possibly the product was mis-counted last stocktake. Was there another box in the back room that was missed? You could re-count that product and similar products to correct the problem.

It isn’t always easy to determine why, but that isn’t an excuse for low standards. Investigating just two or three products might be enough to spot a pattern of behaviour that is affecting most or all of your negative stock problems.

And if all else fails, call your point of sale vendor for advice. They might have the ability to check things out and spot something that you couldn’t.

2. Low Margin

The margin is the difference between what you sell a product for, and what it cost you.

WHY?

Low-margin products are most likely costing you money. Remember that the margin itself (gross margin) is not “pure profit”. That margin must absorb overheads such as power and water, staffing costs, shrinkage, spoilage, discounting and loyalty benefits… basically every expense in your retail business! These margins need to be sufficiently high to sustain your business, so any product that is being sold with a low margin could in fact be costing you money, not making you money.

HOW?

Inventory report again, and this time filter by a low margin percentage.

Don’t have this? Try exporting to Excel and sorting in there.

Most retailers will know what “low” means for their particular niche. Unless you are selling a commodity or are in the supermarket game, we suggest you start by looking at anything less than 10% gross margin. Then once they are adjusted, look at anything less than 20%.

WHAT TO DO?

Work from the lowest margin products that are selling below-cost (zero or negative margin) or with a very small margin. If you have many of these, concentrate on those products that you know are popular, and/or those that are priced high. These are the ones that are costing you the most money.

Some products might be loss-leaders, but never assume these are driving sales of higher-margin products! Check some sales transactions to verify that customers really are buying more than simply low-margin baskets of products.

To fix the problem, consider raising the price of low-margin product, even slightly, to improve profitability.

Or decide to not stock them anymore. You can sell out of your current stock and do not reorder. Why waste retail floor space on unprofitable products?

3. High Margin

High-margin products is an often overlooked area of inventory. They sound great, but might indicate a problem.

WHY?

They could indicate errors in data entry which are better fixed before the product starts selling and throwing out your P&L report. Nobody wants a grumpy accountant complaining that his data is faulty!

If the product is legitimately priced much higher than cost, these may present an opportunity to improve profitability further.

HOW?

This will be the same report as the low-margin products, but with the opposite filter.

Again, if your software doesn’t support this then try exporting to Excel and sorting in there.

WHAT TO DO?

If products are high-margin but not fast sellers, consider discounting them temporarily to see if performance improves. Perhaps your prices are too high and customers don’t see the value?

If products are high-margin AND selling, can you get more out of them? Will positioning them to a better part of the store help? Giving them promotion on your next email newsletter?

The Pareto principle might be at play here: 80% of your shop’s profit comes from 20% of inventory. Your time is valuable. Spending time optimising these few highly-profitable products can yield much bigger results than messing about with the majority of ‘average performing’ products. If products are very high margin it could indicate a data entry failure, particularly in units of measure. Are you purchasing in cartons or trays, and selling as units? Better check recent purchases and sales to make sure the unit of measure is correct and the relationships between cartons and units are defined. We see this a lot in a variety of retail niches, where incorrect units are being used to purchase goods and going unnoticed.

4. Products Not Selling

Every retail manager believes they know their store like the back of their hand. They can walk around it and tell you what’s selling and what isn’t. At least until you run a report that tells you objectively what isn’t selling, not just a gut feel.

WHY?

Products that are not selling are costing you money… to buy them, to store them, and ultimately to discount or throw them out if you can’t sell them. Sure, you often need to stock a range of products to give customers the perception of freedom in their purchasing habits. But don’t be silly about it. Products you can’t sell are costing you money, floor space, and time.

HOW

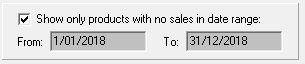

Your system might have a filter on inventory or on hand stock report to only show products in stock with no sales.

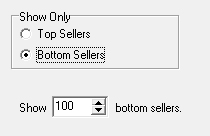

You might also have a report called ‘bottom sellers’ or ‘top sellers’ with a filter that can limit the results

WHAT TO DO

First, is the product actually visible to the customer for sale? We’ve seen many instances where products are reportedly poor sellers. When heading out to the shop floor to find them, we can’t! Maybe they are still in a carton in the back room, or have slipped behind some other product on the shelf. If you can’t find a product, what help have your customers got?

Don’t forget the importance of labelling and signage. Check to make sure the products are priced correctly. We have also observed that merely putting a sign up with the product name and price can help drive sales, more so than a shelf label on its own.

Assuming the product is on the shelf but not getting any takers, consider re-positioning the item to see if it simply is being lost amongst others. Is it placed amongst similar products? Try moving it next to complementary products (products that go with this) rather than having it compete against similar products. Or simply move it to a higher position on the shelf or rack so that it is within customer’s view.

You might want to decide whether you really need to keep carrying that product. Instead of taking up shelf space, would it be better off as a special order buy-in for those few customers (if any) who still want it? Or even better, help staff understand what alternatives exist so that they can inform customers who come looking for it.

Discounting and promotion can help drive sales, but be careful here. You don’t want to forget the reason why you are discounting. We’ve seen instances where a product is discounted and sales go up, only to have staff re-order the product believing it’s a hot seller! Your software might be able to help here. Some POS systems allow you to flag products as not-stocked, so as to not automatically reorder them, or discontinued to prevent reordering altogether.

WHEN TO RUN REPORTS

Ideally the above reports would be run weekly. But we know you are busy, so aim for monthly. If you ran one report each week of the month you’ll get on top of your inventory problems in no time. You will improve stock turns, profitability, and efficiency. And who doesn’t want that when managing a retail business?

Do you have any other reports that help you eliminate inventory headaches? Share your insights by leaving a comment below.